Forex trading, also referred to as foreign trade trading or currency trading, is the international marketplace for buying and offering currencies. It runs twenty four hours a day, five times per week, allowing traders to participate available in the market from anywhere in the world. The primary purpose of forex trading is to make money from changes in currency change charges by speculating on whether a currency couple will increase or drop in value. Players in the forex market contain banks, financial institutions, corporations, governments, and personal traders.

Among the key top features of forex trading is their large liquidity, meaning that large amounts of currency can be purchased and distributed without considerably affecting trade rates. That liquidity ensures that traders can enter and exit positions easily, permitting them to take advantage of also small price movements. Additionally, the forex market is very available, with reduced barriers to access, enabling persons to start trading with fairly small amounts of capital.

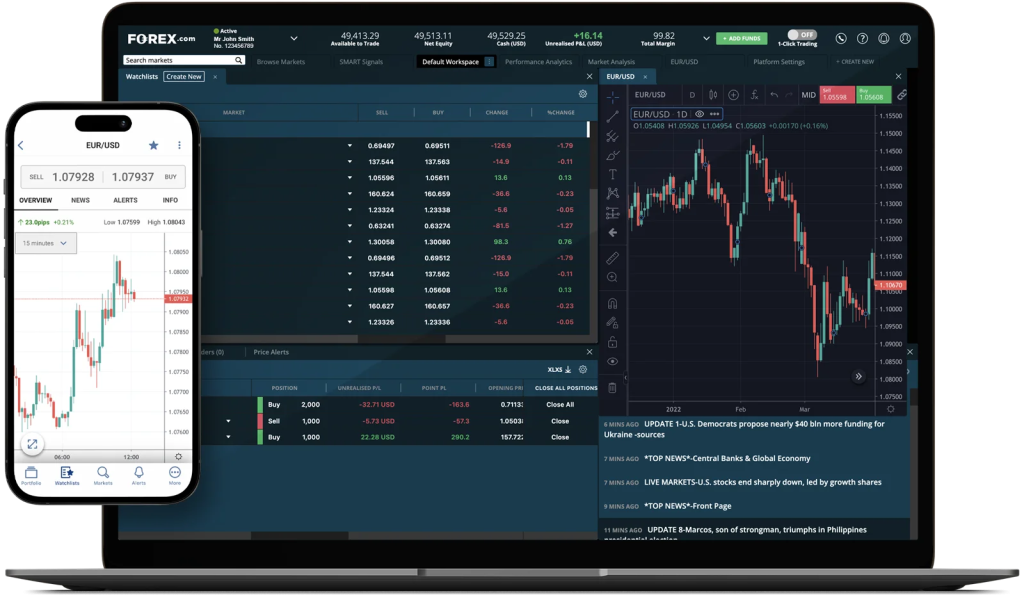

Forex trading provides a wide variety of currency pairs to industry, including major sets such as for example EUR/USD, GBP/USD, and USD/JPY, in addition to slight and incredible pairs. Each currency set shows the change charge between two currencies, with the initial currency in the couple being the base currency and the next currency being the offer currency. Traders may benefit from equally growing and falling markets by getting extended (buy) or short (sell) positions on currency pairs.

Effective forex trading requires a stable knowledge of simple and technical analysis. Simple analysis involves evaluating economic indications, such as for example fascination rates, inflation rates, and GDP growth, to gauge the underlying strength of a country’s economy and its currency. Specialized evaluation, on another hand, involves examining price charts and designs to spot traits and possible trading opportunities.

Risk management is also essential in forex trading to safeguard against potential losses. Traders often use stop-loss requests to restrict their drawback risk and use appropriate place dimension to ensure that no industry may significantly impact their over all trading capital. Also, sustaining a disciplined trading strategy and managing thoughts such as greed and anxiety are crucial for long-term achievement in forex trading.

With the growth of technology, forex trading has be more available than ever before. On the web trading systems and mobile programs provide traders with real-time usage of the forex market, letting them accomplish trades, analyze industry data, and control their portfolios from any device. Moreover, the availability of instructional forex robot sources, including guides, webinars, and trial accounts, empowers traders to produce their skills and boost their trading efficiency around time.

While forex trading offers significant profit potential, it also bears natural dangers, such as the prospect of significant losses. Therefore, it’s essential for traders to perform thorough research, develop a noise trading strategy, and consistently check industry problems to produce educated trading decisions. By sticking with disciplined chance administration techniques and keeping informed about international financial developments, traders may increase their likelihood of achievement in the energetic and ever-evolving forex market.

Leave a Reply